What is the new normal? While this seems to be the latest “buzz” question, it is undoubtedly a valid concern that crosses the minds of business owners and executives as they contemplate surviving the global pandemic.

Never has it been more important to rapidly identify solutions for realigning priorities and supporting strategic decisions. The main challenge, however, is keeping up in a world that is barely recognisable; where uncertainty seems to be the only certainty that prevails. The devastating effects of COVID-19 was felt across a myriad of industries around the globe and almost every organisation - regardless of size has been forced to adapt. While large entities looked towards business continuity and disaster recovery plans as support mechanisms, smaller businesses, despite fewer resources, had the benefit of agility on their side. But how will businesses sustain themselves in the long term?

As we navigate in survival mode, it is clear that moving forward will require far more than knee jerk reactions. Sustainability will depend on how well organisations can innovate amidst adversity to meet the ever-changing needs of the market.

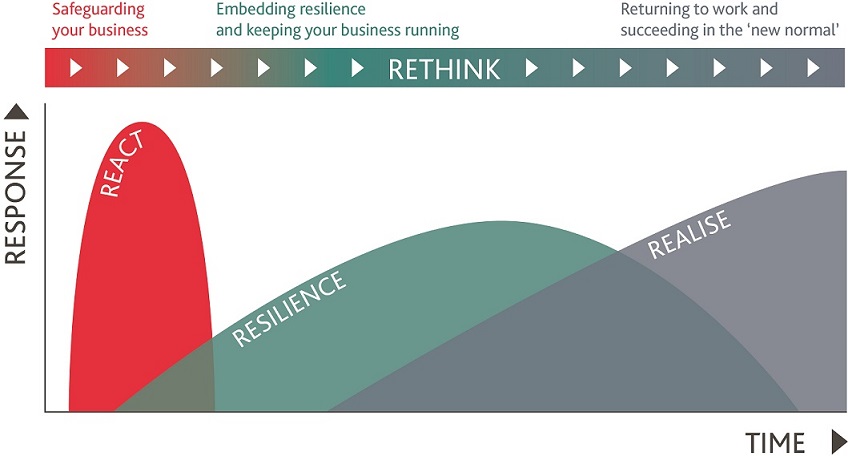

BDO’s Rethink Framework provides support to businesses in identifying the key stages, issues and opportunities available for succeeding. The three-stage model identifies React, Resilience and Realise as components of an integral system that should be embedded within any business. Imagine an application that not only optimises performance but fosters longevity. For the purpose of this article we briefly examine the React and Realise stages, while the primary focus will be on building Resilience.

The stages explained

► React

The React phase involves an initial response to immediate challenges. In this context, we consider the onset of the COVID-19 crisis and the practical first steps that needed to be taken. A focal point in the React stage is the safety of employees, customers, suppliers and people we interact with regularly. In many countries, protection of human capital may be largely driven by Government regulations restricting movement or closing businesses altogether. Like most nations, Guyana implemented a national curfew as part of efforts to minimise the spread of the virus.

These safety measures while absolutely necessary, did not permit adequate time for all businesses to react, consequently causing massive disruption to operations and supply chains. For BDO, and other entities with digital resources, the nature of work allowed a swift change to operating from home. As our team found creative ways of collaborating, we remained accessible to clients while adhering to regulatory measures and ultimately protecting the people around us. Some industries however, were not as fortunate - most notably Hospitality & Leisure, where remote working arrangements were impractical, and subsequently resulted in widespread layoff and scale down. During this period many organisations including SMEs suffered immense losses, with those relying on tourism among the most vulnerable business groups.

The React phase of the model highlights key considerations in mitigating the effects of negative circumstances by quickly assessing options available and operationalising a crisis management plan.

► Resilience

With increased need for businesses to recover quickly, the second stage, Resilience, provides guidance on adapting and maintaining operations during disruptions. Resilience objectives include but are not limited to:

- Operating more efficiently

- Optimising costs

- Identifying profitability quick wins

- Developing customer segmentation strategy

- Improving customer value

- Improving working capital efficiency

- Reconfiguring the supply chain

- Navigating the return to work

- Increasing workforce productivity & flexibility

- Source & structure M&A deals

While there is no one-size-fits-all solution, but rather combinations which will be unique to every entity, these objectives should always be guided by a concise, well communicated vision. Often, difficult decisions must be made and having a clear, reinforced vision ensures the organisation stays on the right path without straying into counter-productive activities.

Notwithstanding a firm purpose and commitment, the ability to pivot quickly but perhaps more important- efficiently, can help to curb falling productivity and decreased revenue. Changing course however, should be data driven and requires accurate, pertinent and timely information to support sound decision making. Situational analysis is vital at this stage for businesses seeking and evaluating options. While the degree of detail may vary across entities, PEST and SWOT are useful tools for considering organisational strengths and analysing internal and external factors. Identification of market trends may highlight opportunities and provide valuable insight on adapting or possibly changing products or services. The switch by companies offering personal care products to providing sanitisers and other cleaning supplies to meet increased demand is a great example of effective pivoting. These entities were able to identify opportunities quickly and re-allocate resources which may otherwise have been wasted.

By also focusing on high value customers, high performing product/service lines and new market opportunities, businesses may be able to maintain overall business performance. As organisations contend with weak sales and slow down in operations they need to ask: how do we continue to meet customer expectations and innovate amidst harsh conditions? Meeting objectives at this stage could mean accepting a new reality with digitalisation at the core. While some companies have the resources on hand to invest in technology, too many are reluctant to do so because of high capital costs and additional considerations such as re-training staff. However, there has been a noticeable shift towards digitalisation throughout the pandemic with increasing need for businesses to meet their customers on digital platforms. Even in Guyana, a traditionally cash-based economy, we have seen a significant change in consumer expectations for contactless payments and mobile banking. Businesses that can adapt to accommodating those needs will surely benefit from customer acquisitions and repeat sales.

This however does not diminish the need for addressing financial issues and associated challenges. Going concern is now a major topic of interest for regulators and auditors as liquidity ratios and other metrics reveal higher levels of non-paying customers affected by the pandemic, lower sales and falling profitability. Businesses should consider approaching banks and other lending institutions to re-negotiate debt financing and other credit facilities. Having up to date financial information has also become a necessity for managing through the crisis and businesses can hardly afford to procrastinate on forecasting and cash flow management. Organisational resiliency is enhanced when a business is in control of its finances and has cash to cover debts and meet obligations throughout a disruption.

As the oil industry continues to attract foreign investment, potential strategic partners also have a keen interest in financials. A component of the resiliency stage of the framework evaluates the viability of mergers and acquisitions during the downturn. Local businesses have increased opportunities to obtain financing through partnering or merging with global entities.

Risk management has rightfully earned its spot as a top contender of key considerations related to organisational resilience. Evaluating best and worst case scenarios especially in respect of the supply chain is only a small part of risk mitigation that businesses need to be engaged in today. It is critical to develop, as far as possible, an all-encompassing list of threats facing the organisation. These may include cyber security, fraud detection and even project risks.

Mitigating tax risks involves analysing the changes and concessions available, and carefully managing cash flow to meet revised deadlines. Businesses should attempt to accelerate the refund process through timely applications as overpayments represent non-productive funds which could otherwise be used to reduce debt or support innovation.

Remaining compliant requires constant review to keep abreast with frequent changes in legislation and national policies. It is worthwhile to also pay keen attention to safety and health standards while regularly updating your company’s HSSE manual. As Guyana slowly moves towards re-opening, organisations can develop a return to work plan, providing consideration to possible changes in regulation and uncertainty regarding timing and extent of recovery.

It is important to distinguish that Resiliency need not be boxed into a specific set of actions. Each organisation may gauge resilience by its ability to engage in core activities and thrive amidst turmoil.

► Realise

We may still be some distance away from a post-COVID world, but there is ample reason for optimism. In the Realise phase, businesses look at ways to apply key learnings from the React and Resilience activities by continuing to adapt to new ways of working and serving clients. It involves planning for the longer term by anticipating business trends, establishing a new reality of demand and supply and identifying clear areas for transformation. Meeting or exceeding market needs is still possible for organisations willing to think beyond immediate challenges.

While business models may look vastly different in years ahead, organisations embracing the Rethink model will be stronger and future ready.

ABOUT THE AUTHOR

Nadia Latchana is a business consultant and director at BDO Professional Services Inc. She holds a Diploma in Marketing from the University of Guyana and a Master of Business Administration from the Australian Institute of Business.